For tablet computer visionary Roger Fidler, a lot of what-ifs – The Washington Post.

This story is yet another one of those hard luck “I had the idea first but am a poor schmuck while others are billionaires” cases. We can think of many other such stories: Marconi scooping Tesla to be “known” as the inventor of the wireless radio because he commercialized it first; Davy being the real inventor of the electric light bulb and Le Prince the developer of moving pictures — ideas soon taken and capitalized on by Edison; and the development of that wonder of modern society — the internet — stolen from Al Gore by a bunch of geeks (ok I made the last one up).

another one of those hard luck “I had the idea first but am a poor schmuck while others are billionaires” cases. We can think of many other such stories: Marconi scooping Tesla to be “known” as the inventor of the wireless radio because he commercialized it first; Davy being the real inventor of the electric light bulb and Le Prince the developer of moving pictures — ideas soon taken and capitalized on by Edison; and the development of that wonder of modern society — the internet — stolen from Al Gore by a bunch of geeks (ok I made the last one up).

What the story of Roger Fidler shows is how great ideas are everywhere but rarely do they come to fruition without those complementary assets — other technologies, finances, good project planning, marketing, and so on — that make them work for ordinary folks. I sometimes hear business people and policy wonks saying that Innovation = Invention + Commercialization (I first saw this presented by BCG two decades ago) but this is invariably wrong. Innovation = Invention * Commercialization. Invariably good innovation requires Invention => smart people with the right skills working on things diligently; plus Commercialization=> all those things that are necessary to make inventions useful the huddled masses in the market place. Rarely can you separate the two as the skills associated with commercialization will inform invention, making it more targeted and efficient. At the same time the skills that drive invention open up individuals to possibilities they never imagined (e.g., who thought 30 years ago that people would want to use “portable” computers — certainly not Ken Olsen, founder of Digital Computer who famously stated “There is no reason anyone would want a computer in their home.” — or that they would want a computer with more power than a calculator — certainly not Bill Gates who believed 16 bits was enough (“We will never make a 32 bit operating system.”)

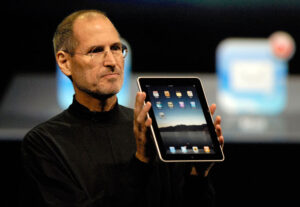

In Fidler’s case we see a classic story where his ideas where simply beyond what his organization could absorb. In addition, we see how knowledge spillover works. One does not necessarily need an organization to generate the ideas that lead to products if that organization can create the architecture on which ideas are developed, enhanced and converted into products. Indeed, what the Apple story in this article, plus a somewhat similar case with respect to the Ipod, reveals the how effective Apple is at creating and owning and exploiting this architecture. As Pierre Richard and I discussed in an article in California Management Review there is considerably more money to be earned by controlling the architecture than controlling the manufacturing or even aspects of the invention or construction. In some sense, the ability to see how the parts fit is the key asset, not the components (which can be bought and sold and hence outsourced or sourced depending on the need).

Recent Comments